Virtual and Augmented Reality to Nearly Double Each Year Through 2021

Spending on augmented and virtual reality will nearly double in 2018, according to a new forecast from International Data Corp. (IDC), growing from $9.1 billion in 2017 to $17.8 billion next year. The market research company predicts that aggressive growth will continue throughout its forecast period, achieving an average 98.8 percent compound annual growth rate (CAGR) from 2017 to 2021.

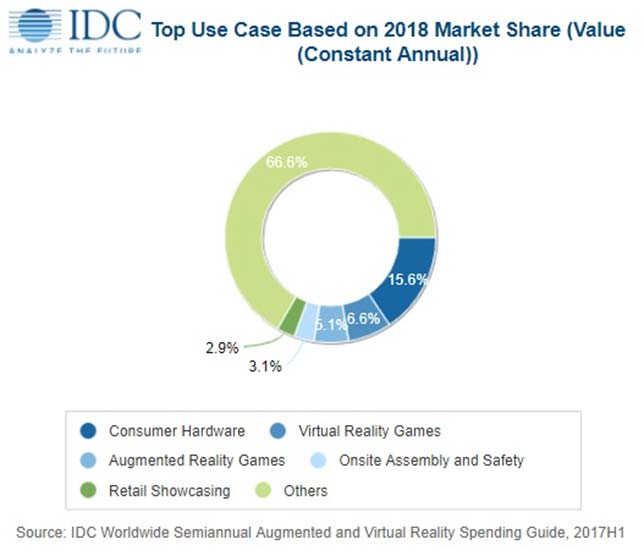

Consumer spending will be the single largest source of spending on AR and VR in the near term, accounting for $6.8 billion in 2018, with about three quarters of that spending going toward virtual reality hardware and software. The majority of spending on augmented reality in 2018 will go toward software. Spending by consumers will grow more modestly than the market overall, increasing at an average CAGR of 45.2 percent to reach $20 billion in 2021. Gaming will be the leading consumer use case for VR and AR throughout the forecast period.

All commercial sectors combined will account for 60 percent of AR and VR spending in 2018, according to IDC, and will grow to account for more than 85 percent of all spending by 2021.

"Each of the five commercial sectors is forecast to undergo triple-digit spending growth throughout the forecast, led by the public sector with a five-year CAGR of 156.7 percent," according to a news release.

The distribution and services sector will take the lead in 2018, accounting for $4.1 billion in spending, followed by manufacturing and resources at $3.2 billion. The individual industries projected by the company to lead spending on VR and AR in 2018 are retail, process manufacturing and construction.

"Virtual reality will continue to drive greater levels of spending in the next 12-18 months, as both consumer and commercial use cases gain traction. There is currently a huge appetite from companies that see tremendous potential in the technology, from product design to retail sales to employee training," said Tom Mainelli, program vice president for devices and AR/VR at IDC, in a prepared statement. "Meanwhile, the augmented reality market will deliver more modest levels of spending near term with mobile AR on smartphones and tablets likely to garner the most attention from consumers, while head-mounted displays will primarily sell into commercial use cases."

The United States will be the region responsible for the most spending in 2018, at $6.4 billion, and will see accelerated growth until spending is projected to peak in 2020. The Asian/Pacific region, which excludes Japan, will trail U.S. spending in 2018, at $5.1 billion, and will similarly experience slowed growth toward the end of the forecast. The U.S. and the Asian/Pacific region will both experience an average CAGR in excess of 100 percent throughout the forecast period, though they will trail Canada, the leader in that respect, and Eastern Europe, at 139.9 percent and 113.5 percent CAGR, respectively.

"Commercial entities are ready to embrace virtual reality for both customer-facing use cases and internal ones," said Marcus Torchia, research director of IDC Customer Insights & Analysis, in a prepared statement. "There are a lot of opportunities here to develop commercial-grade hardware and applications that meet the needs of these industries. Meanwhile, phone-based AR is likely to garner most of the excitement for the near term and many companies are already experimenting with AR apps and services. Some of these will be useful, many won't be, but over the course of the next 12–18 months, we should start to see developers beginning to grasp the potential of AR."

About the Author

Joshua Bolkan is contributing editor for Campus Technology, THE Journal and STEAM Universe. He can be reached at [email protected].