Server Market Contracts, While Increased Price Points Drive Revenues Upward

Server shipments declined in the first quarter of 2019, while revenues increased compared to the same period a year ago.

In Q1 2019, total worldwide server shipments reached 2.6 million units, a decline of 5.6 percent. But revenues were up worldwide at $19.8 billion, an increase of 4.4 percent compared to Q1 2018, according to a report released by market research firm IDC.

According to IDC: “The overall server market slowed in 1Q19 after experiencing six consecutive quarters of double-digit revenue growth, although pockets of robust growth remain. Volume server revenue increased by 4.2 percent to $16.7 billion, while midrange server revenue grew 30.2 percent to $2.1 billion. High-end systems contracted steeply for a second consecutive quarter, declining 24.7 percent year over year to $976 million.”

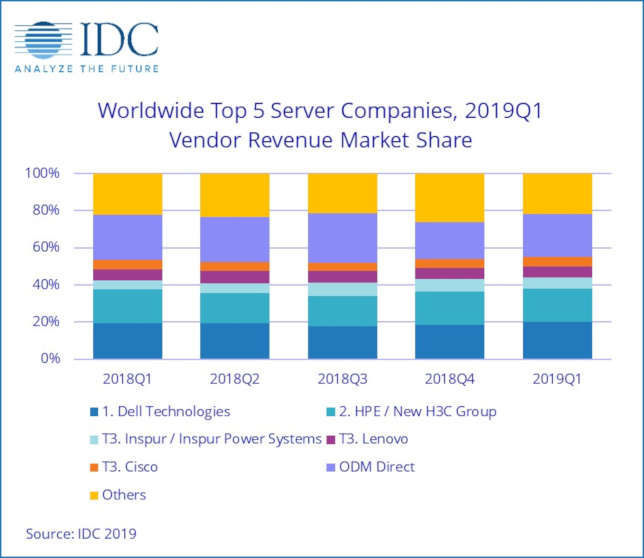

Dell Technologies was the top vendor with a 20.2 percent share of the market (up from 19.3 percent in the same quarter last year). Revenues were up 8.9 percent to $3.99 billion. The company shipped 517,000 units, down 7 percent from last year.

HPE/New H3C Group came in second with a 17.8 percent market share, down from 18.5 percent last year. Revenues were up 0.2 percent to $3.52 billion. Unit shipments declined 10.9 percent to 406,000.

Inspur/Inspur Power Systems, Lenovo and Cisco essentially tied for third place in the worldwide server market in terms of revenues. (See chart.) Of all the top vendors, only Inspur/Inspur Power Systems saw an increase in unit shipments. The company shipped 204,900 servers, an increase of 17 percent over Q1 2018.

According to IDC, “On a geographic basis, Japan was the fastest growing region in 1Q19 with 9.8 percent year-over-year revenue growth. Asia/Pacific (excluding Japan) grew 7.4 percent during the quarter, while Europe, the Middle East and Africa (EMEA) grew 4.1 percent on aggregate. The United States grew 3.5 percent; Canada declined 9.6 percent; and Latin America contracted 14.9 percent. China saw its 1Q19 vendor revenues grow 11.4 percent year over year.”

“Demand for x86 servers increased 6.0 percent in 1Q19 to $18.5 billion in revenue. Non-x86 servers contracted -13.7 percent year over year to $1.3 billion.”

More information can be found on the IDC site.