Interactive Tool Examines Lawmaker Student Debt Stance

- By Dian Schaffhauser

- 03/13/17

At the same time a bipartisan group of lawmakers is promoting a tax incentive for employers who help students pay down their student loan debt, a new interactive tool lets users examine just how much their senators and congressmen care about their own state's or district's level of student debt.

The tool, developed by lendedu, a marketplace for student loans and student loan refinancing, is actually a compilation of data related to the student debt lawmaking activities of each member of the U.S. Senate and the House of Representatives.

Among the findings shared by "Congress & Student Debt": Student loan borrowers from states with two Democratic senators had an average of about 25 percent more student debt than borrowers from states with two Republican senators. Yet borrowers from Republican-held states defaulted on their student loans about 55 percent more often than those from Democratic-held states. Borrowers from districts with a Republican representative defaulted on their loans about 26.2 percent more often than those from a district with a Democratic representative.

Also, for both houses, the Democrats tend to support student loan and college affordability initiatives much more frequently than their Republican counterparts.

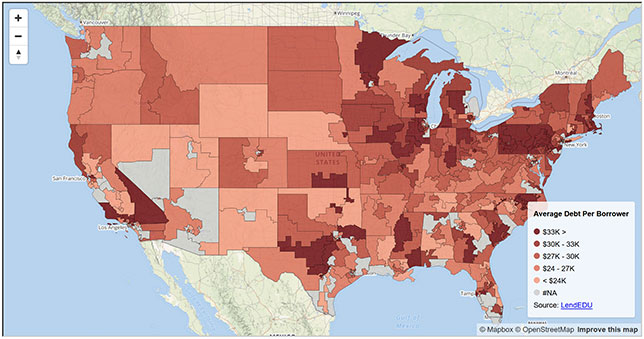

Interactive maps on the site allow users to view student debt by state and senator as well as by congressional district and representative. A state list displays information about each member of Congress and the higher education initiatives he or she supports.

For example, U.S. Congressman Rodney Davis (R-IL) represents a district with a considerably higher average student debt per borrower ($32,356) than the national average ($28,000). The proportion of graduates with student debt is 85 percent; however, the district's default rate is just 4.57 percent, far lower than the 11.8 percent national default rate. Recently, Davis introduced H.R. 795, the "Employer Participation in Student Loan Assistance Act," which would grant employers tax breaks for helping their employees pay off student debt.

His original co-sponsor on that was Scott Peters (D-CA), whose small district doesn't register in the lendedu interactive tool, but whose loan default rate is a whopping 15.7 percent.

Under the bill, employers could contribute up to $5,250 per year to their employees specifically to help pay down their student debts without the employees having to pay taxes on the contribution.

As Davis explained in a press release, "This debt is a drag on our economy because it prevents many young adults from contributing to our economy. Many are putting off buying a house, purchasing a car or saving for retirement. The Employer Participation in Student Loan Assistance Act encourages employers to be part of the solution by allowing them to offer a tax-free employee benefit that will help graduates pay down their student debt." Davis suggested that companies offering this kind of benefit would have an advantage in recruiting and hiring.

The bill has since gained support from 42 additional cosponsors, 24 Democrats and 18 Republicans. The party disparity there is typical, suggested lendedu in its report. Democratic representatives support more initiatives on average (4.77of the six proposed so far) than Republican representatives (1.71 of the six).

But it doesn't explain why there are more student loan defaults in Republican-controlled districts than Democratic districts. As the authors of the lendedu report noted, "College affordability is not a top priority for many of these senators and representatives, and their states may be suffering as a result."

About the Author

Dian Schaffhauser is a former senior contributing editor for 1105 Media's education publications THE Journal, Campus Technology and Spaces4Learning.